This document is explaining the process of creating a module pool for the SAP CO Month End Process. The objective is to provide a simplified screen to the end user to complete the month end process. Normally this process will be done by an ABPER, but it can be done by a functional consultant with a little bit knowledge on coding which is very simple.

Note: The document is appears to be lengthy because of adding detailed screens for every step.

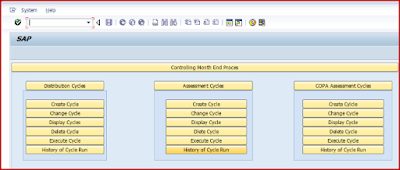

I have provided the detailed steps to complete the process. Before going into the details, end result of the screen to be developed is as follows:

Note: The document is appears to be lengthy because of adding detailed screens for every step.

I have provided the detailed steps to complete the process. Before going into the details, end result of the screen to be developed is as follows: