Purpose

I would like to provide a document that outlines the basics of SAP tax configuration and provides a couple of examples of how tax code could be determined in SD and MM.

Overview

FI Tax Basics

I would like to provide a document that outlines the basics of SAP tax configuration and provides a couple of examples of how tax code could be determined in SD and MM.

Overview

- SAP provides the majority of the tax configuration out of the box by country

- There are three SAP areas that work together to determine taxes FI,MM, and SD

- FI – Base configuration for tax procedures, rates and accounts

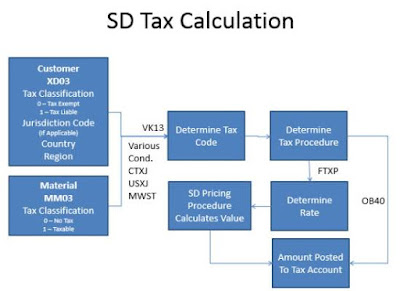

- SD – Configuration/master data to determine output tax code

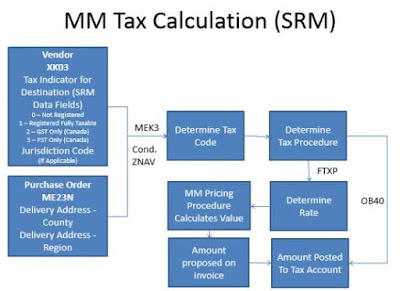

- MM – Configuration/master data to determine input tax code

- Master data such as customer, vendor, and material, as well as transactional data like POs and Sales Orders are key to determining the correct tax

- Rates can be maintained in SAP or SAP can call an external system for them (this document with focus on rates maintained in SAP)

FI Tax Basics

- Tax configuration is done by country

- All company codes in the country share those settings

- Two Main Components:

- Tax Calculation Procedure – Provide the method of calculation – normally use SAP standard

- Tax Codes – Provide the rates

- These are provided by SAP for each country – General recommendation is to use delivered logic

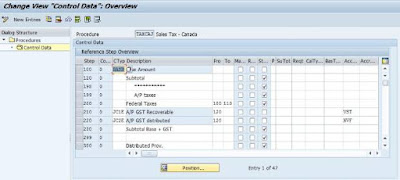

- Tax Procedure, related conditions, and access sequences can be viewed in transaction SPRO at the path Financial Accounting Global Settings>Tax on sales/Purchases>Basic Settings>Check Calculation Procedure

- Steps define calculation, conditions, and account assignments

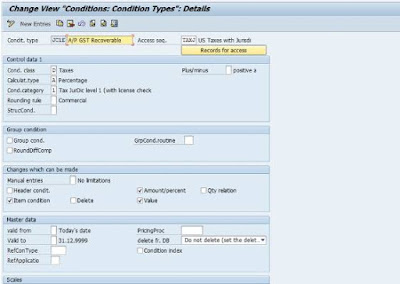

Condition Type Example

- Condition record defines access sequence, and other characteristics about the condition

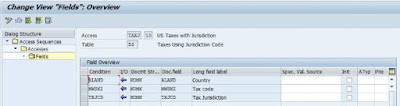

Access Sequence Example

- Access Sequence defines field required to access a condition

- For example to find a condition for the entry below the system will use Country, Tax Code, and Tax Jurisdiction

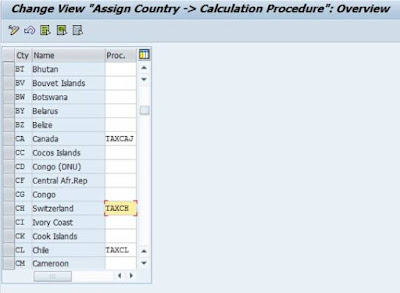

Configuration - Assign Tax Procedure to Country

- Tax Procedures are assigned to countries in transaction OBBG

Tax Jurisdictions

- Represent government authorities to which taxes need to be paid

- SAP allows up to 4 levels tax jurisdictions representing state, country, city, and others

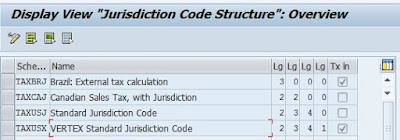

Configuration - Jurisdiction Code Structure

- Tax Jurisdiction structure must be defined in transaction OBCO

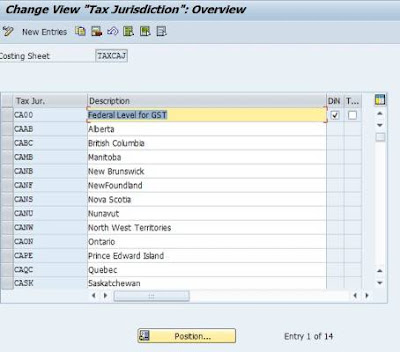

Configuration - Maintain Jurisdiction Codes

- Jurisdiction codes are maintained manually in transaction OBCP for tax procedures that do not use an external system

Tax Codes

- Tax Codes are maintained by country and jurisdiction code

- They define the rate that is used in calculation

- They are maintained in transaction FTXP

- Don’t be confused on the name, this transaction can create,maintain, and display tax codes

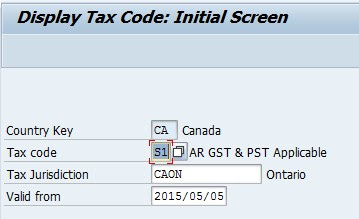

Tax Code - Properties

- The properties of the tax code identify its code, name, type (input vs output) and other information about it

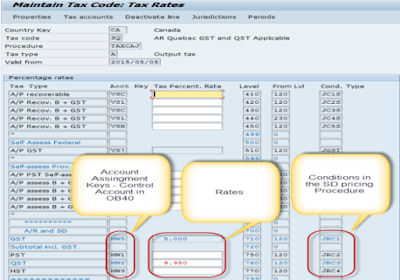

Tax Code - Tax Rates

- In the tax rate screen you enter the appropriate tax rates

- You can also see the account assignment key and the conditions that are used to calculate a value in the follow on transactions such as SD invoice

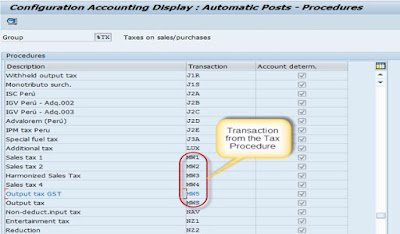

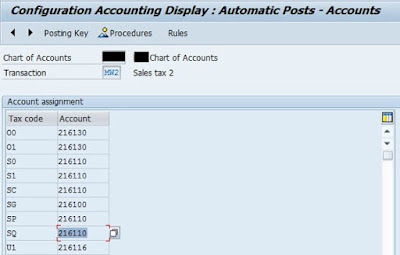

Tax Account Determination

- Accounts are assigned in transaction OB40

- You can also see the account assignment key and the conditions that are used to calculate a value in the follow on transactions such as SD invoice

Tax Code Determination

- At the end of the day the tax is determined based on the tax code and the tax procedure on the AP or SD invoice

- SAP multiple ways to determine the tax code, condition tables, master data, programs, manual entry, etc.

- Method can be different by situation

- This document shows an example of how a tax code could be determined for an SD invoice (output tax) and SRM Pos/invoices (input tax)

Source: scn.sap.com

ReplyDeleteSAP MM Training Chennai, furnish the best training with Real-time projects. We configured the course as for the Industrial demands. We offers long-term support.

sap mm training in chennai