I just want to share if anyone may need. It is complete scenario from configuration to planning, actual posting and final revaluation. I used some of the comments/posts on the forum - That I see it valuable and clear

1. Master data & set up

1.1 KL01-Create activity type

1. Master data & set up

1.1 KL01-Create activity type

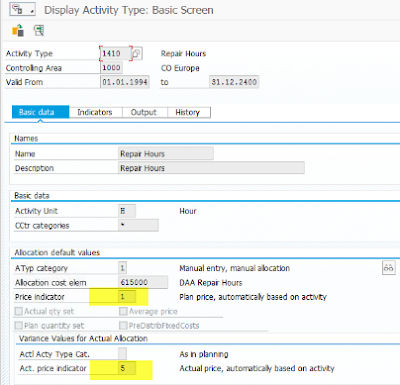

- Set the ‘Price indicator’ to “1” (Plan price, automatically based on activity) in the ‘Allocation default values’ section in order that the plan prices are calculated automatically. -> This means that the cost center budget entered in transaction KP06 will be divided by the quantity entered in transaction KP26 when you run the plan price calculation in transaction KSPI.

- You need to set the ‘Act. Price indicator’ to “5” (Actual price, automatically based on activity) in the ‘Variance Values for Actual Allocation’ section in order that the actual prices are calculated automatically. This means that the actual costs posted a cost center will be divided by the actual quantity consumed in the cost center when you run the ‘Actual Price Calculation’ in transaction KSII.

1.2 OKEV - Controlling Area settings:

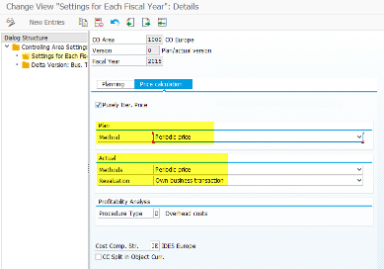

You can decide the method used to c alculate activity prices by setting the appropriate indicators in the Controlling Area settings. To do this go to transaction OKEV, highlight the appropriate version and double-click on the folder “Settings for each fiscal year”. Then double-click on the appropriate year and go to the tab “Price Calculation”.

In the ‘Plan’ section, you can choose the method for calculation the price which can be “Periodic” (where the budget for each period is divided by the quantity of that period) or “Average” (where the budget for all the periods are divided by the quantity for all periods and the result is assigned to every period).

In the ‘Actual’ section you also choose one of the above mentioned methods.

In addition you need to specify whether you want the difference between the actual and plan price is updated in the same transaction that was originally posted or if it should be posted in a different transaction. You do this by selecting the relevant indicator in the “Revaluation” field

For actual activity price calculation, the cost object that the cost center’s quantities have been consumed in can be revalued based on the “Revaluation” setting mentioned above. In order for the revaluation to take place however, you need to run a separate transaction for the cost object (after you have run the actual price calculation transaction KSII). This transaction will depend on the type of cost object that is being revalued. See the below table for the cost objects and their corresponding revaluation transactions.

Cost Object

|

Revaluation Transaction (Individual)

|

Revaluation Transaction (Collective)

|

Production Orders

|

CON1

|

CON2

|

Process Orders

|

CON1

|

CON2

|

Product Cost Collectors

|

CON1

|

CON2

|

QM Orders

|

CON1

|

CON2

|

Networks

|

CON1

|

CON2

|

Internal Orders

|

KON1

|

KON2

|

Note that if you use the Material Ledger to calculate actual costs of your materials, then you do not need to run the above revaluation transactions. Instead, you can set the ‘Activity Update Indicator’ to “2” (Activity update relevant to price determination) in the ‘Activate Actual Costing’ transaction (SPRO – > Controlling -> Product Cost Controlling -> Actual Costing/Material Ledger -> Actual Costing -> Activate Actual Costing). You would then also need to set up the general ledger account that the cost center will be credited with by going to transaction OBYC and entering the account in transaction key/general modification GBB/AUI.

2. Plan Price Calculation

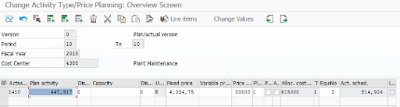

2.1 KP26: Cost Center activity quantities planning

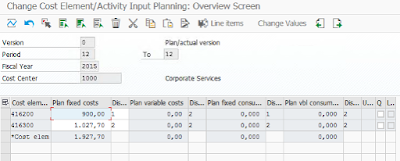

2.2 KP06: Cost center Cost planning

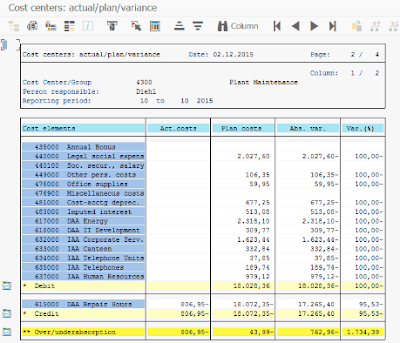

Report on cost center plan/ actual:

2.3 KSPI Activity Rate Calculation/ PLan

Run this function to let system calculate plan activity rate. This will be used to when do activity confirmation.

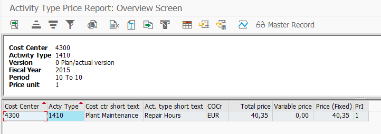

KSBT: report on activity type price / plan

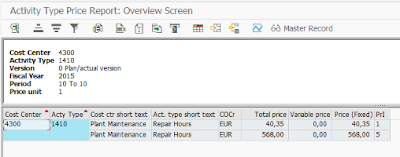

Result after run KSPI

3. Actual Activity Price Revaluation

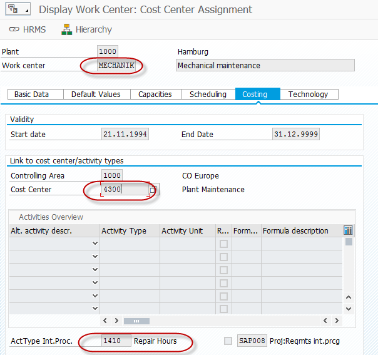

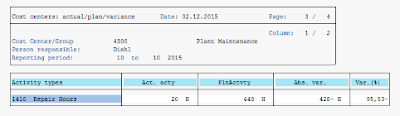

Scenario: work center ELECENG is assigned to Cost center 4300 with activity type 1410.

1.3.1 Display work center to see the relationship bw work center/ cost center/ activity type

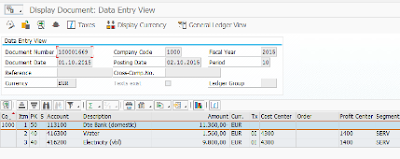

3.2 FB50 Actual cost posting to cost center

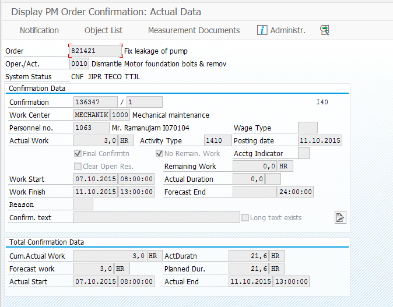

3.3 Actual Activity Confirmation via Maintainence Order

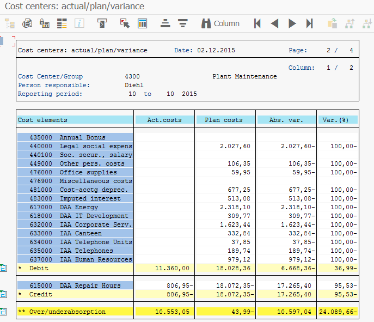

3.4 S_ALR_87013611 - Cost center Report after actual posting

Credit = 806,95 (activity unit price x activity quantity)

- activity type quantity plan vs actual

4. Revaluation

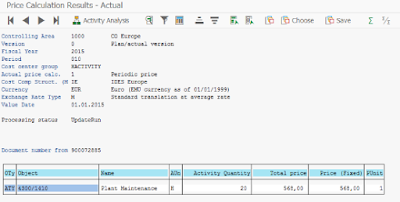

4.1 KSII: Actual activity price revaluation

Make Sure API=5 in T-Code KBK6

Price 568 = total cost 11360/ total activity 20 -> correct

In this example, an document is generated when run KSII is because of one of the IOs have closed status, then that IO can not be revaluated, system posted to a cost center instead.

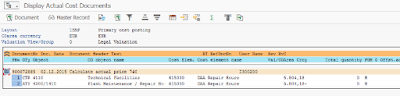

Display revaluation document (will see why at the end of this document)

KSBT – Actual activity type is calculated

KON1 – Revaluation at actual price (KON2 for collective processing)

You may face "Inappropriate status" if IO have close status -> can not revaluate IO anymore -> system post to other cost object/ cost center right after run KSII function as seen above.

Final result: actual debit = actual credit, over/under absoption = 0

Source: scn.sap.com

thanks for the information sap simple finance training in chennai

ReplyDelete