The below article will explain one of the approaches through which Inventory can be valued on FIFO basis in SAP -

We have two approaches to present our Inventory on FIFO basis -

1. Batch Input Method - A batch capturing the Receipt Value and the Quantity for every GR is maintained in the system. At the time of Goods Issue, the system will fetch the value from the batches in the ascending order.

2. Balance Sheet Valuation Method - In this approach, the goods are valued at the Moving Average Price throughout the period and at the Period-end date, an adjustment entry is posted to bring the inventory at the FIFO method.

I will discuss the configuration steps of Balance Sheet Valuation Method here.

Before beginning with the configuration of this approach, let me explain with an example for what exactly this approach will do -

Taking a single Material (say A) for which below movements happened -

We have two approaches to present our Inventory on FIFO basis -

1. Batch Input Method - A batch capturing the Receipt Value and the Quantity for every GR is maintained in the system. At the time of Goods Issue, the system will fetch the value from the batches in the ascending order.

2. Balance Sheet Valuation Method - In this approach, the goods are valued at the Moving Average Price throughout the period and at the Period-end date, an adjustment entry is posted to bring the inventory at the FIFO method.

I will discuss the configuration steps of Balance Sheet Valuation Method here.

Before beginning with the configuration of this approach, let me explain with an example for what exactly this approach will do -

Taking a single Material (say A) for which below movements happened -

| S.No | Movement | Quantity(KG) | Price Per Unit($KG) | Amount($) | Moving Average Price($) |

| 3. | Goods Issued | 15 | 137.50 (MAP picked up) | 2062.50 | 137.50 |

| 4. | Goods Issued | 10 | 137.50 (MAP picked up) | 1375.00 | 137.50 |

| 1. | Goods Received | 10 | 100.00 | 1000.00 | 100.00 |

| 2. | Goods Received | 30 | 150.00 | 4500.00 | 137.50 |

Closing Stock @ MAP = 15 Kgs @ Rs. 137.50 = Rs.2062.50/-

Closing Stock @ FIFO = 15 Kgs @ Rs. 150.00 = Rs.2250.00/-

Valuation Variance = +Rs. 187.50/-

Under this approach, system will identify the material movements (in/out) within the period based on assigned Movement Types (Transaction Code - OMW4) and calculate the FIFO price as Rs. 2250.00.

The FIFO run can then compare the FIFO value with the Book Value and revalue the inventory to the FIFO Price and post the revaluation entry. It will use the accounts in OBYC - INV and PRD based on the valuation class of the material and post the below entry to bring in the financial impact of above valuation -

Inventory Account Dr. 187.50

Price Difference Cr. 187.50

The above entry will post the differential amount entry to bring the Inventory Value of selected materials at FIFO without changing the transactional data entered during the period.

Now, explaining on the configuration steps to achieve the above functionality -

1. Activating FIFO Valuation

- Menu Path: SPRO>IMG> Material Management> Valuation and Account Assignment> Balance Sheet Valuation Procedures Configure LIFO/FIFO Methods> General Information> Activate/Deactivate LIFO/FIFO Valuation (Tcode - OMWE)

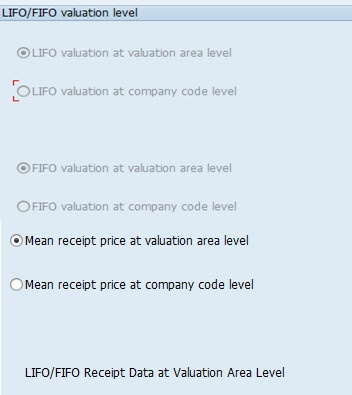

2. Defining Valuation Levels

- SPRO>IMG> Material Management> Valuation and Account Assignment> Balance Sheet Valuation Procedures Configure LIFO/FIFO Methods> General Information> Define LIFO/FIFO Valuation Levels (Tcode - OMWL)

- This is an important step because we can set valuation level either at Valuation Area or Company Code level. Once saved and entries posted for valuation, changing this will require changing database and a program needs to be called up to pursue that.

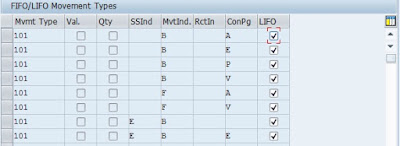

3. Define FIFO Relevant Movement Types

- SPRO>IMG> Material Management> Valuation and Account Assignment> Balance Sheet Valuation Procedures Configure LIFO/FIFO Methods> General Information> Define LIFO/FIFO Relevant Movement Types (T.Code - OMW4)

- This is another step which will define the valuation. We have to define the FIFO relevant Movement Types which can be used for Inventory Value calculation. You may check SAP Note # 167330 - Relevant receipts for LIFO/FIFO valuation to select relevant movement types for FIFO.

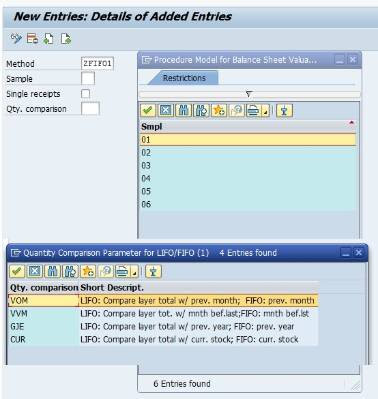

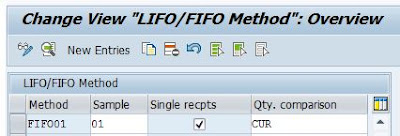

4. Define FIFO Methods

SPRO>IMG> Material Management> Valuation and Account Assignment> Balance Sheet Valuation Procedures Configure LIFO/FIFO Methods> General Information> Define LIFO/FIFO Methods. (T.Code - OMWP)

The method can be copied from any of the standard methods or can be created afresh.

- Method - 6 digit alphanumeric identifier for the method.

- Sample - SAP provided 6 samples as shown below. 01 is only to be used for FIFO. Rest others are for LIFO.

- Single Receipts indicator - This indicator will identify if you allow the system to value on each inward movement or not. If this is unchecked, then system will pick collective monthly movements.

- Quantity Comparison - This field will identify the comparison inventory value with which SAP will check the FIFO value and show/post the variance. It has four options provided by SAP -

- VOM - Previous Month - If this option is assigned to a FIFO Method, system will check the FIFO value calculated against book value of material as on last date of the previous month (MM Period). For e.g. If the previous period is October and current period is November, then System will check the FIFO value calculated (say $100) with the Material Book Value as on October 31 (say $95), and display/post the variance of $ 5.

- VVM - Month before Last - Using this option means System will check the FIFO value calculated ($100) with the Material Book Value as on September 30 (say $97), and display/post the variance of $ 3.

- GJE - Previous Year - Using this option means System will check the FIFO value calculated ($100) with the Material Book Value as on October 31 last year (say $90), and display/post the variance of $ 10.

- CUR - Current - Using this option means System will check the FIFO value calculated ($100) with the Material Book Value as on FIFO run date (say $99), and display/post the variance of $ 1.

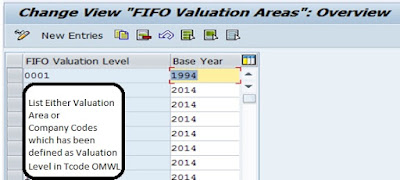

5. Configure FIFO Valuation Areas (Defining Base Year)

SPRO>IMG> Material Management> Valuation and Account Assignment> Balance Sheet Valuation Procedures Configure LIFO/FIFO Methods> FIFO> Configure FIFO Valuation Areas

With the above five steps, configuration is complete to allow system to run Balance Sheet Inventory Valuation on FIFO Basis.

Now, from end-user point of view, three transaction codes needs to be executed to complete the FIFO run during Month-end -

1. MRF4 - FIFO Valuation: Flag Materials -

- Logistics> Materials Management> Valuation> Balance Sheet Valuation> FIFO Valuation> Prepare> Select Materials

- Executing this transaction code will flag the materials for getting picked in FIFO run. User can restrict the run for specific materials/company codes/plants etc. Material Codes which are not flagged for FIFO will not be considered for FIFO Valuation Run.

Note - Make sure to tick the Update "Material Master and FIFO Index Table" option. Without ticking this, nothing will happen.

2. MRF3 - FIFO Valuation: Create Document Extract -

- Logistics> Materials Management> Valuation> Balance Sheet Valuation> FIFO Valuation> Prepare> Create Document Extract

- This step will allow system to select the transactions to be considered for FIFO Valuation. This selection is based on the FIFO method defined (OMWP)(Single/Monthly receipts tick) and the movement types defined as FIFO relevant (OMW4)

- The output will show the Movements in the materials included/excluded while drafting the document extract for FIFO run.

Note - Ensure ticking Update Receipt Data. Otherwise nothing will get selected for FIFO run.

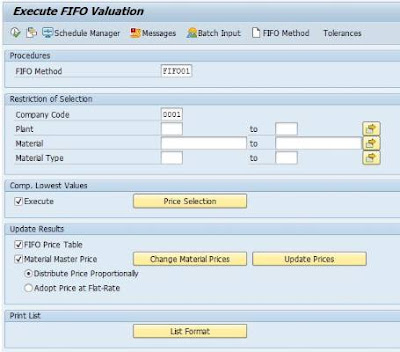

3. MRF1 - Execute FIFO Valuation -

- This is the main step where user can select -

- Whether any financial postings should be made or only report display is needed.

- Lowest Value Principle needs to be considered or not.

- FIFO Price tables to be updated or not.

- Material Master data to be updated with the FIFO price or not.

- These above decisions are purely business requirement based.

- The output of this step will display the material wise variance (Book Value and Calculated FIFO Value) and GL Account wise variance as well.

This concludes the entire FIFO Valuation Run which can help you revalue the inventory on FIFO Basis in the Financial Statements without touching the MM module. Further, it can be put to use for displaying the impact of change in accounting policies wherein a shift from FIFO to MAP is made by any organisation.

Source: scn.sap.com

thanks for the information sap simple finance training in chennai

ReplyDelete