This document is about how we can activate the cost component split in CO area Currency. Also we will see how it affect to Cost Component Split in CK11N.

If your controlling area currency is not the same as the company code currency, CCS is always updated in company code currency. If we would like to see CCS in CO area Currency, we should maintain it on OKYW tcode.

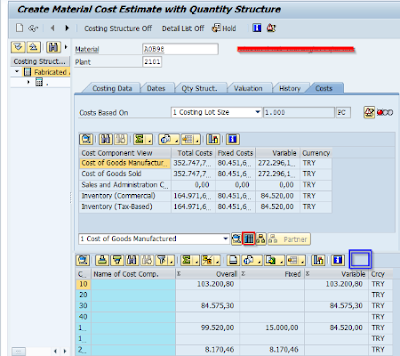

Before maintain OKYW, CK11N screen is as follows.

If your controlling area currency is not the same as the company code currency, CCS is always updated in company code currency. If we would like to see CCS in CO area Currency, we should maintain it on OKYW tcode.

Before maintain OKYW, CK11N screen is as follows.