This is the continuation of the document DMEE Configuration.

Please refer the below link for the DMEE Configuration:Step By Step Part 1.

Create/Assign Selection Variants (OBPM4)

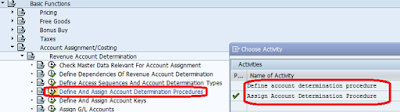

A. Accounts Receivable and Accounts Payable ® Business Transactions ® Outgoing Payments ® Automatic Outgoing Payments ® Payment Media ® Make Settings for Payment Medium Formats from Payment Medium Workbench ® Create/Assign Selection Variants

Please refer the below link for the DMEE Configuration:Step By Step Part 1.

Create/Assign Selection Variants (OBPM4)

A. Accounts Receivable and Accounts Payable ® Business Transactions ® Outgoing Payments ® Automatic Outgoing Payments ® Payment Media ® Make Settings for Payment Medium Formats from Payment Medium Workbench ® Create/Assign Selection Variants