Now that you know what does CFOP means and what is used for, it is time to know how to configure the CFOP on SAP in 5 steps:

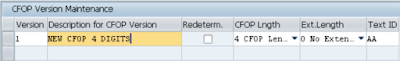

1 – Define CFOP Version

The first activity necessary is “DEFINE CFOP VERSIONS” and you can do that either maintaining the table/view J_1BCFOPVERV or via IMG path “Cross-Application Components > General Application Functions > Nota fiscal > CFOP Codes > Define CFOP Versions”.

Now a days it is not necessary to maintain the old CFOP length version anymore, then, enter the following data:

Version: 1

Description for CFOP Version: NEW CFOP 4 DIGITS

Redeterm: Considering your SAP installation is new, you don’t have the old CFOP format (replaced in 2003), then, it is not necessary to activate this check.

CFOP Lngth: 4 CFOP Length

Ext. Lngth: 0 No Extention

Text ID: AA (or anything such as: A, 01, etc)

1 – Define CFOP Version

The first activity necessary is “DEFINE CFOP VERSIONS” and you can do that either maintaining the table/view J_1BCFOPVERV or via IMG path “Cross-Application Components > General Application Functions > Nota fiscal > CFOP Codes > Define CFOP Versions”.

Now a days it is not necessary to maintain the old CFOP length version anymore, then, enter the following data:

Version: 1

Description for CFOP Version: NEW CFOP 4 DIGITS

Redeterm: Considering your SAP installation is new, you don’t have the old CFOP format (replaced in 2003), then, it is not necessary to activate this check.

CFOP Lngth: 4 CFOP Length

Ext. Lngth: 0 No Extention

Text ID: AA (or anything such as: A, 01, etc)

2 – Assign validity date to CFOP Versions

Once you have created the CFOP version, it is time to assign the validity date to the version created. Here you can also assign a version to a region (state) if required.

Follow the path “IMG > Cross-Application Components > General Application Functions > Nota fiscal > CFOP Codes > Assign Validity Date to CFOP Versions” or use the SM30 to maintain the table/view J_1BCFOP_XREGNV.

Type Valid-From, Country, Version.

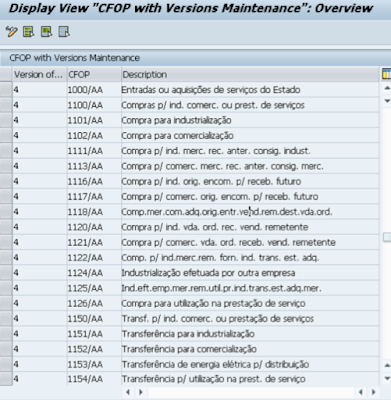

3 – Define CFOP Codes and Assign Version

You can maintain the view J_1BAGNV or follow the customizing path: IMG > Cross-Application Components > General Application Functions > Nota fiscal > CFOP Codes > Define CFOP Codes and Assign Version

The CFOP codes and respective descriptions are part of a legal system to define the exactly operation for every goods movement going from or coming to the plant or company in Brazil.

You should ask for a full list of CFOP codes and description to the company Taxes and Fiscal department. You may want to ask me adding a comment here and I will forward it to you.

Check a sample below:

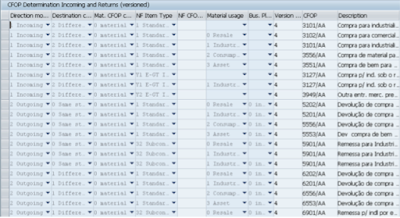

4 – Define CFOP Determination for Goods Receipts and returns

In this activity, you define the entries in the CFOP determination table for incoming movements (goods receipts) and their returns. The system uses these entries in the Materials Management components Logistics Invoice Verification and Inventory Management. The rules from this table will define automatically the correct CFOP for that specific operation during the goods incoming.

You can use the view J_1BAONV or the path IMG > Cross-Application Components > General Application Functions > Nota fiscal > CFOP Codes > Define CFOP Determination for Goods Receipts and Returns (Versioned)

See below an example:

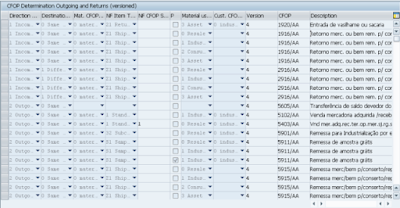

5 – Define CFOP Determination for Goods Issue and returns

You define the entries in the CFOP determination table for outgoing movements (goods issues) and their returns. The system uses these entries in Sales and Distribution and Materials Management – Inventory Management. The rules from this table will define automatically the correct CFOP for that specific operation during the goods incoming.

You can do it maintain the view J_1BAPNV or via customizing menu: IMG > Cross-Application Components > General Application Functions > Nota fiscal > CFOP Codes > Define CFOP Determination for Goods Issues and Returns (Versioned)

See an example below:

You can find more details about CFOP checking SAP OSS Note 571848.

Source: scn.sap.com

ReplyDeleteSAP MM TrainingChennai, furnish the best training with Real-time projects. We configured the course as for the Industrial demands. We offers long-term support.

sap mm training in chennai

Nice and informative post. Thanks for such a wonderful post.

ReplyDeleteSAP FICO Training

thanks for the information sap simple finance training in chennai

ReplyDelete