Background

In SAP ERP the document splitting is the most powerful tool is widely and most commonly used. With this function the document splits the line items based on the “Characteristics” we define in system. Often this function is used to get the financial statements correctly for segment reporting.

Back to the Basics

Concept can be explained of document splitting with the help of one of the most basic business transaction as “Vendor Invoice”. Suppose we have vendor invoice as below which consists of two expense line items say 10,000 in total with 1,000 of tax component which sums to 11,000.

In SAP ERP the document splitting is the most powerful tool is widely and most commonly used. With this function the document splits the line items based on the “Characteristics” we define in system. Often this function is used to get the financial statements correctly for segment reporting.

Back to the Basics

Concept can be explained of document splitting with the help of one of the most basic business transaction as “Vendor Invoice”. Suppose we have vendor invoice as below which consists of two expense line items say 10,000 in total with 1,000 of tax component which sums to 11,000.

- Expense Item 1 for 8,000 where it is assigned to PC - X

- Expense Item 2 for 2,000 where it is assigned to PC - Y

| Account | Amount | Profit Centre |

| Vendor A/C | -11,000 | |

| Expenses 1 | 8,000 | PC – X |

| Expenses 2 | 2,000 | PC – Y |

| Input Tax | 1,000 |

If any person is responsible for PC – X wish to analyze the transactions performed for PC – X, but unfortunately the user can’t - because of, if you look at the transaction the “Vendor Balance” and “Input Tax” is cumulative and hence is not assigned to any of the profit center either X or Y.

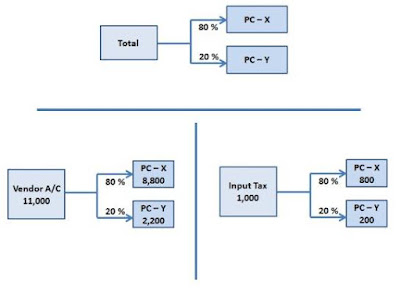

Now if you look at the transaction above it represents that the total expense is distributed in the ratio of 80% and 20% and same of Profit Centre of X and Y. So base to this the Vendor Balance and Input Tax should also have split according to 80%-20% rule.

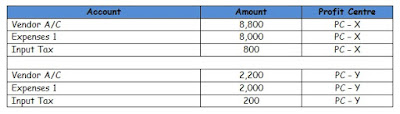

As per the above image the system should have posted the document as per below financial transaction entry in system -

Okay so the conclusion for whole exercise is, if the user can post the document as above, the reporting will be pretty particuar and balanced and there won’t be a problem – issue is re-solved.

Its easily said that issue will be solved but why any user will separate the line item as per calculations and split its bases always on its ratio, especially when there are 100’s of line items sometimes in any document ! And what if system takes care of this?

Well the answer is Yes, and that’s what the document splitting is all about!

Now we will understand the Document Splitting elements and key concepts

- Passive Splitting – This type of splitting is mostly occurs when the payment transaction is posted for a vendor invoice. Now system splits the payment document bases on how the vendor invoice was split in place already.

- Active Splitting – In Active Splitting the document is split according to mySAP ERP predefined rules. SAP almost supports all the business process transactions but if it doesn’t suit to any requirement the own splitting rules can be created.

- Zero Balancing Splitting – When the amounts within financial documents are not able to balance out to Debit of Profit Centre and Credit of Profit Centre which does not Net Off as its own, SAP then automatically generates new line item to balance the document. We will see the example in following section of this scenario.

- Item Category - Item category categorizes the general ledger accounts for document splitting. In the configuration each GL account is assigned to item category. Just to name a few like 01000 – Balance Sheet Account, 02000 – Customer, 03000 – Vendor and so on.

- Business Transaction – Business transaction is real scenario of business processes happens in organization such as vendor invoice, customer invoice etc.

- Business Transaction Variant – In the SAP, financial postings are derives the item category for individual line item. Business transaction variant always works in conjunction with business transaction where business transaction restricts the business processes to be posted to. System validates a check all postings against the item category to validate if these postings are allowed by splitting rule if not then understand this failed.

- Document Splitting Method – Document splitting method works in combination with business transaction and business transaction variant it determines the document splitting rule.

- Document Splitting Rule: Document splitting rule determines which item categories will be split and from which item categories it will derive the account assignment.

Let us see the actual example from system of Document Splitting for vendor invoice

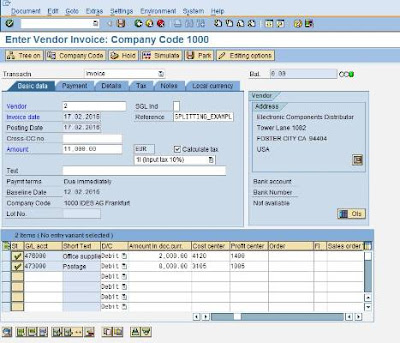

If we are posting an invoice from FB60 with two different expenses line item as below with two different cost centers assigned now system has derived the profit center from its cost centers mentioned in line item.

Simulate this document to see pre-posting view with line item and associated assignments.

Now press F3 or Back button and come to main screen. Now go to Menu Bar Document --> Simulate with General Ledger to see the ledger view of this document.

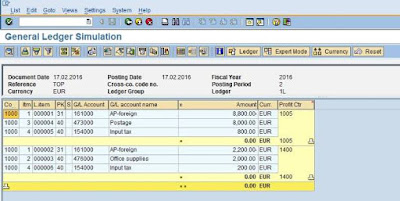

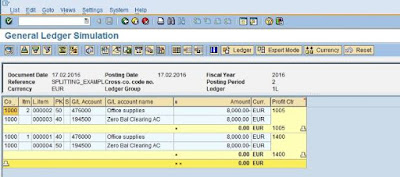

Once clicked on simulate with general ledger, document can be seen as below as “Document Split” functionality.

Document Splitting - Zero Balancing

As discussed above when system is not able to balance out the transaction entry based on its own it balances out by “zero balancing” account. System adds the zero balance account at its own to make balance zero for transaction. We will see the example for this now –

We will post the transaction via FB50.

Now simulate this with General Ledger View as below

If you look at above and notice simulated “General Ledger View” system has automatically generated the “Zero Balance Clearing A/C.”

Now let us look at the configuration of document splitting

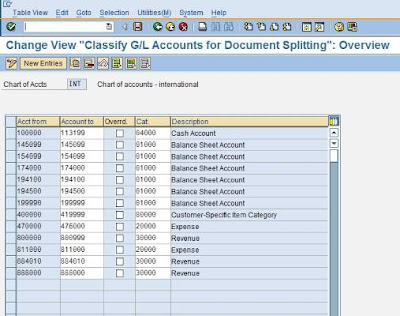

1. Classify GL Accounts for Document Splitting

SPRO --> SAP Reference IMG --> Financial Accounting (New) --> General Ledger Accounting (New) --> Business Transaction --> Document Splitting --> Classify G/L Accounts for Document Splitting

Here in this step GL’s are classified according to item categories according to business transaction nature. It is recommended that instead of assigned item category to each individual general ledger account try maintaining the item categories for “Range of General Ledger Accounts”.

2. Classify Document Types for Document Splitting

SPRO --> SAP Reference IMG --> Financial Accounting (New) --> General Ledger Accounting (New) --> Business Transaction --> Document Splitting --> Classify Document Type for Document Splitting

In this step the “Business Transaction” and “Business Transaction Variant” is assigned to document types. Now almost every financial transaction in considered for document splitting.

3. Define Zero Balance Clearing Account

SPRO --> SAP Reference IMG --> Financial Accounting (New) --> General Ledger Accounting (New) --> Business Transaction --> Document Splitting --> Define Zero Balance Clearing Account

In this step we have to define the zero balance clearing account which will be used to generate and balance out financial entry when it is not possible to balance out at its own, as we have seen this example earlier.

4. Define Document Splitting Characteristics for General Ledger Accounting

SPRO --> SAP Reference IMG --> Financial Accounting (New) --> General Ledger Accounting (New) --> Business Transaction --> Document Splitting -->Define Document Splitting Characteristics for General Ledger Accounting

This is one of the most important configurations step in document splitting. In this step we have to define the splitting characteristics. Additionally you can define whether this should be Zero Balance and Mandatory.

5. Edit Constants for Non Assigned Processes

SPRO --> SAP Reference IMG --> Financial Accounting (New) --> General Ledger Accounting (New) --> Business Transaction --> Document Splitting -->Edit Constants for Non Assigned Processes

In this step the constants are defined which helps to assigned the default account assignment when is not able to derive from any of the sources.

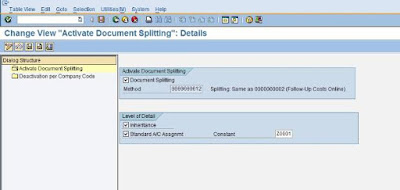

6. Activate Document Splitting

SPRO --> SAP Reference IMG --> Financial Accounting (New) --> General Ledger Accounting (New) --> Business Transaction --> Document Splitting -->Activate Document Splitting

Finally the step to activate document splitting with additional settings like “Inheritance” and Activation of Document Splitting.

Select check box “Document Splitting” and apply appropriate method. SAP Standard pre-delivered method is “0000000012”.

Selecting the Inheritance signifies the line items which do not have account assignment will derive the account assignment from other line item.

Selecting Standard A/C Assgnmnt means system will set the standard account assignment for non-assigned line items. When this indicator is selected “Constant” needs to be maintained.

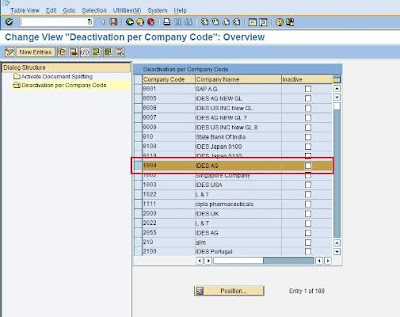

Activate of Document Splitting happens at client level but it is always possible to control of activation and deactivation at company code level.

Source: scn.sap.com

Thanks for sharing the information SAP FICO Training

ReplyDelete

ReplyDeleteSAP MM TrainingChennai, furnish the best training with Real-time projects. We configured the course as for the Industrial demands. We offers long-term support.

sap fico training in chennai

thanks for the information sap simple finance training in chennai

ReplyDelete