Introduction:

Material ledger (ML) is functionality in SAP, which helps to calculate Actual Cost for materials and also provide the facility of multiple parallel valuations in multiple currencies. ML has two major functionalities, first to calculate actual cost of materials, semi/finished goods, and second provide an opportunity to calculate actual cost on multiple valuation such as Legal, Group, & Profit center valuation. In this document we will see fundamental concept of material ledger, how the actual cost is calculated for different business scenarios.

Actual Costing in SAP

Actual Costing has a purpose of calculating actual cost for goods manufactured in-house and materials procured from outside. Calculation of actual cost for finished goods, raw materials is very difficult as we don’t know many of actual costs when business transactions are performed. Business transactions are performed throughout the months and at that time we don’t know the actual cost of our production activities, expenses for full months, total activities performed in month, overhead cost etc., so it’s become difficult to calculate actual cost for finished goods, raw material purchased from outside. The situation becomes more difficult when we talk about a Multinational organization having manufacturing plants in different countries and transfer of goods is happening between groups.

Material ledger works on a concept on first recording the material movement in Standard Cost and then accumulating the Variance to calculate the Actual cost.

Material ledger (ML) is functionality in SAP, which helps to calculate Actual Cost for materials and also provide the facility of multiple parallel valuations in multiple currencies. ML has two major functionalities, first to calculate actual cost of materials, semi/finished goods, and second provide an opportunity to calculate actual cost on multiple valuation such as Legal, Group, & Profit center valuation. In this document we will see fundamental concept of material ledger, how the actual cost is calculated for different business scenarios.

Actual Costing in SAP

Actual Costing has a purpose of calculating actual cost for goods manufactured in-house and materials procured from outside. Calculation of actual cost for finished goods, raw materials is very difficult as we don’t know many of actual costs when business transactions are performed. Business transactions are performed throughout the months and at that time we don’t know the actual cost of our production activities, expenses for full months, total activities performed in month, overhead cost etc., so it’s become difficult to calculate actual cost for finished goods, raw material purchased from outside. The situation becomes more difficult when we talk about a Multinational organization having manufacturing plants in different countries and transfer of goods is happening between groups.

Material ledger works on a concept on first recording the material movement in Standard Cost and then accumulating the Variance to calculate the Actual cost.

In Material ledger the benefit of standard cost is retained as all the materials movements are initially recorded at Standard Cost and variances are collected to come to actual cost. Actual cost is calculated at the end as part of Period End Closing, and the actual cost is termed as Periodic Unit Price (PUP).

Periodic Unit Price (PUP)

- Periodic Unit Price refers to the average actual cost of materials in material ledger.

- For material procured from outside, PUP represent Standard Cost plus Capitalized Purchasing variances (like, purchase price variance, exchange rate variance etc.)

- For in-house produced material, PUP represents Standard Cost plus manufacturing variances (like quantity variances from raw material & activity, purchase price variance, multi-level variances coming from raw materials etc.)

- For calculating the PUP, only opening stock and receipt is consider, but not the consumption.

- Consumption is revalued at closing cost. First the consumption is booked at standard cost and then it’s revalued during ML period end closing, with the difference of New PUP and Standard Cost.

- PUP is updated in Accounting View 1 of material master data.

Pre requisite for Material ledger

a. Material price determination should be 3 (i.e. Single/Multilevel price determination)

b. All procurement cost should be linked to purchase order

c. All manufacturing cost, overhead expenses should be part of activity cost (i.e. product cost value flow)

Different Scenarios:

Scenario 1: External Procurement of Raw Materials

Step 1: Purchase requisition: No journal entries, as it’s a pre-commitment.

Step 2: Purchase order: No journal entries, it’s a commitment for Budget

Step 3: Goods receipt: when we receipt the raw material, at that time we are not aware of our actual cost of material then the initial recognition happened at Standard cost.

Stock of Raw material A/c ………….. Debit (Std. Cost * Actual Qty.)

To, GR/IR A/c… (Credit) (Std. Cost * Actual Qty.)

The value posted at GR is equals to (Std. Cost of raw material multiplied by Actual Quantity receipt)

Material ledger: at the time of good receipt, in material ledger there is an entry happened for receipt under purchase, where entry happened for stock quantity & value is recognized as standard price.

Step 4: Invoice Receipt:

GR/IR A/c ……………………………………. Dr. (Std. Cost * Actual Qty.)

Exchange rate difference A/c …………Dr. (Exchange rate variance)

Purchase Price Variance A/c ………… Dr. (Balancing figure)

To Vendor A/c (Invoice Value)

Material ledger: at the time of invoice receipt the purchase price variance is recognized in material ledger under zero quantity receipt, which increases the actual price of cumulative inventory. In some of cases we can also see exchange rate variances at time of invoice receipt. Exchange rate variance generally arises when the transaction currency is different than legal currency and average actual exchange rate is different than budgeted exchange rate.

Scenario 2: In-house production of Finished goods

Step 1: Goods Issue to Production/ Process Order

Raw Material Consumption A/c ……………… Dr. (Std. Cost * Actual Qty)

To, Stock of Raw material A/c ….. Cr (Std. Cost * Actual Qty)

In Controlling, Order should be debited with raw material consumption with a value equals to (Std. Cost * Actual Qty).

In Material Ledger, consumption entries will happen for raw material with Consumption of Raw material quantity as Actual quantity issue to order and value of consumption as (Std. Cost * Actual Qty).

Step 2: Activity Confirmation for completion of production activity

When production/ process order activities are confirm, then order is debited/charged with the cost of activity (Plan Activity rate * Actual Activity), and the production cost is credited. This entry is passed in Controlling, but no entries happened in FI.

Step 3: Goods receipt, finished goods receipt as part of order completion.

Stock of Finished Goods A/c ………………… Dr. (Std Cost * Actual Qty) BSX

To, Finished Goods manufacture A/c (Std Cost * Actual Qty) GBB

In Controlling, order is credited with cost of finished goods manufactured i.e. (Std Cost of FG * Actual Qty produced).

In Material Ledger, there will be entry in the receipt for finished goods. Inventory/volume in KG will increased by quantity receipt during goods receipt and value will increased by (Standard cost of FG * Actual Quantity receipt)

Step 4: Variance Calculation & Settlement

Once we do the variance calculation then variance represents the difference between Total cost charged to process/production order and Cost of Finished good receipt. These variances basically represent quantity variance of raw material and activity. i.e. (Actual Quantity less Plan Quantity)* Standard rate.

Variance calculated at this step gets posted in Material ledger to adjust the actual cost of finished goods produced.

Scenario 3: Sales of Finished goods (FG)

Step 1: Sales order; no accounting entries are created in FI. No impact in material ledger.

Step 2: Goods Issue to Customer; when goods issued to customer, in financial accounting the entries are recorded for actual quantity sold @ Standard cost of finished goods.

Cost of Goods Sold A/c ………………………….. Dr. (Std. cost of FG * Actual Quantity)

To, Finished goods Inventory A/c (Std. cost of FG * Actual Quantity)

In Material ledger: goods issue to customer is recorded in material ledger as consumption of raw material. The Actual quantity is recognized at standard cost.

Step 3: Billing document released

Customer A/c ……………………………………..DR

To, Sales Revenue A/c

Step 4: Payment receipt,

Bank A/c …………………………………………DR

To, Customer A/c

Step 5: Period end closing: when we do period end closing activity in ML, the consumption is revaluated with the different between actual cost (periodic unit price) and standard cost of finished goods. The price difference & exchange rate difference are proportionately adjusted between consumption & closing inventory.

Illustration:

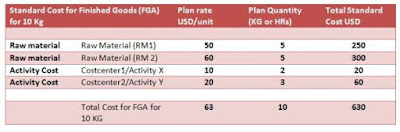

To illustrate the scenario in more details, assume that we are manufacturing finished goods FGA, which is made of raw material RM1 & RM2, and two activity X & Y are performed to convert raw material in finished goods. In below table represent Plan standard cost of finished goods.

Table 1

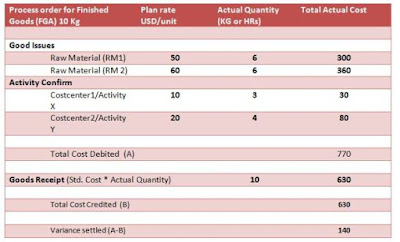

Assume that we have created a production order to manufacture 10 kg of finished goods FGA. The details of value which will be posted at different task like Goods issue, Activity confirmation & goods receipt are given below. I have assumed actual quantity as different then plan quantity so that we can check variances.

Table 2

Here we can see the total variance of 140 USD, basically represent quantity variance.

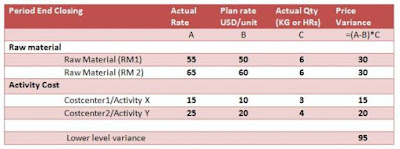

Table 3

Assumed, actual rate different than plan rate. Here we can see the calculation of lower level variance.

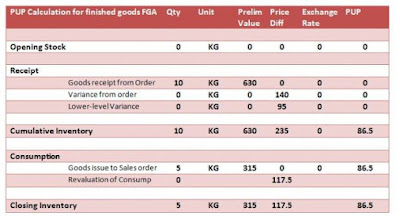

PUP Calculation for finished goods FGA

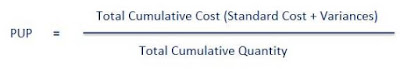

PUP is calculated on the ratio of total cumulative cost with total cumulative quantity. The formula is given below.

In the below table the calculation of average actual cost is shown

- Assuming the opening stock is zero in table 4.

- Goods receipt from order is actual quantity @ standard cost. Details can be verified from Table 2.

- Variance from order of 140 USD is basically the difference between total debit cost & total credit cost to production order, which is quantity variance. (Table 2)

- Lower level variance of 95 USD is price variance (Table 3)

- PUP is {(630+235)/10} = 86.50 USD/Kg

- Goods issue to sales order is initial recorded at Std. cost

- Revaluation of consumption {(PUP – Std Cost)*Actual Qty} i.e. {(86.5 – 63.0)*5} = 117.5 USD

- Closing inventory is also revaluated with PUP.

Table 4

Conclusion:

With the help of this document I have tried to focus on basic functioning of material ledger with concept. It will help to understand how the variances are moved from raw material, activity to finished goods & to closing inventory and consumption.

Source: scn.sap.com

This comment has been removed by the author.

ReplyDeleteI want to share a testimony on how Le_Meridian funding service helped me with loan of 2,000,000.00 USD to finance my marijuana farm project , I'm very grateful and i promised to share this legit funding company to anyone looking for way to expand his or her business project.the company is funding company. Anyone seeking for finance support should contact them on lfdsloans@outlook.com Or lfdsloans@lemeridianfds.com Mr Benjamin is also on whatsapp 1-989-394-3740 to make things easy for any applicant.

ReplyDeleteone of the finest document on ML ever. Thanks for sharing knowledge

ReplyDelete

ReplyDeleteSAP MM TrainingChennai, furnish the best training with Real-time projects. We configured the course as for the Industrial demands. We offers long-term support.

sap fico training in chennai

Thanks for sharing the information SAP FICO Training

ReplyDeletethanks for the information sap simple finance training in chennai

ReplyDelete