This is in continuous of my other document of understanding Standard Costing and its flows.

Basics of Standard Costing - Understanding the Cost Component Structure-Part 3

Overhead costs are costs which can only indirectly be attributed to the product, such as electricity or general storage costs. We can allocate these overhead costs in various ways: Here I have discussed about overhead calculation through costing sheet. This is a beginner's guide to understand the costing Sheet.

Overhead application

In the conventional method, overhead is applied to the reference object as a percentage rate or a quantity-based rate. The overhead is applied by means of costing sheets. The very purpose of using a cost sheet is that we want to apply indirect costs to the final cost of the product or process. Costs that cannot be assigned to the product cost collector directly can be allocated by determining the overhead expenses and applying them to the cost collector. Overhead costing is the means by which we allocate indirect costs to the appropriate objects.

The costing sheet links all the functions of overhead calculation. The direct costs to which overhead is applied (calculation base),The conditions under which overhead is applied (dependency),Whether overhead is allocated on a percentage basis or on a quantity basis, The amount of the overhead percentage, or the amount of overhead for each unit of measure (overhead), The validity period for the overhead, Which object (cost center, process, or order) is credited, and under which cost element in the case of actual postings (credit key)

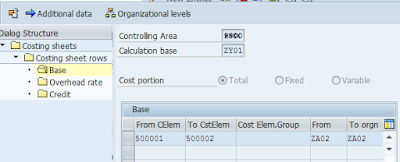

Define Costing Sheet- T CODE KZS2

Basics of Standard Costing - Understanding the Cost Component Structure-Part 3

Overhead costs are costs which can only indirectly be attributed to the product, such as electricity or general storage costs. We can allocate these overhead costs in various ways: Here I have discussed about overhead calculation through costing sheet. This is a beginner's guide to understand the costing Sheet.

Overhead application

In the conventional method, overhead is applied to the reference object as a percentage rate or a quantity-based rate. The overhead is applied by means of costing sheets. The very purpose of using a cost sheet is that we want to apply indirect costs to the final cost of the product or process. Costs that cannot be assigned to the product cost collector directly can be allocated by determining the overhead expenses and applying them to the cost collector. Overhead costing is the means by which we allocate indirect costs to the appropriate objects.

The costing sheet links all the functions of overhead calculation. The direct costs to which overhead is applied (calculation base),The conditions under which overhead is applied (dependency),Whether overhead is allocated on a percentage basis or on a quantity basis, The amount of the overhead percentage, or the amount of overhead for each unit of measure (overhead), The validity period for the overhead, Which object (cost center, process, or order) is credited, and under which cost element in the case of actual postings (credit key)

Define Costing Sheet- T CODE KZS2

AAAAA costing sheet has been created for Example

Costing Sheet has 3 important components within it.

-Base

-Overhead rate

-Credit

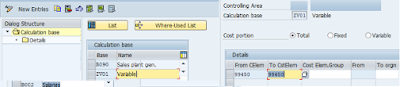

Defining Base- T CODE KZB2

The calculation base consists of a group of cost elements to which overhead is to be applied according to the same conditions. This process involves assigning individual cost elements or cost element intervals for each controlling area to a calculation base.

We can apply different overhead amounts to the fixed and variable portions of the same base cost element. We can also make the amount of the overhead dependent on not only the direct costs, but also on the material itself. We can define material-specific calculation bases by entering the origin groups in the material master record and by specifying them in the calculation bases.

Example ZV01 base

The calculation base determines to which cost elements overhead is applied together.

For each controlling area, we assign individual cost elements or cost element intervals, or origins or origin intervals, to the calculation bases.

For production overhead costs, we can differentiate between fixed and variable costs for the calculation base. In this way, we can charge the fixed and variable portions of the activity price differently for activity types.

For material overhead costs, we can differentiate the materials used. If we want to define different material overhead costs for particular raw materials, we can define origin groups and define where own calculation bases for particular origin groups. (Origin group need to be defined)

If we do not specify any origins for a cost element interval, the SAP System considers all the origins in the relevant interval.

-Overhead rate here we can define Quantity or percent base overhead rate

Percent based Overhead rate T CODE KZZ2

Percent based overhead rate

Quantity based Overhead rate- T CODE KZM2

Quantity based overhead rate.

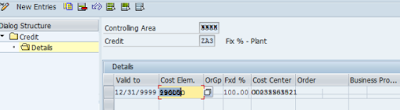

-Define Credit T CODE-KZE2

Cost allocation is part of the process of determining overhead rates. If this leads to an object being debited with actual costs, another object in Cost Accounting must be credited at the same time. This can be either a cost center, order or a business process. This type of posting is recorded under a secondary cost element of cost element category 41 (overhead rates) in the SAP System.

When you define credits, you also specify which credit object is to be credited under which cost element when overhead is to be applied to an object in the actual.

You can also define what percentage of the overhead is to be allocated as fixed costs.

Defining credit (Cost center being credited in the example)

Define Origin Groups T CODE OKZ1

Here you can create origin groups. These groups serve to subdivide the material costs further. For controlling purposes, materials assigned to the same cost element by automatic account determination can be separated into origin groups. You enter the origin group in the costing view of the material master record. Account determination assigns each material to a G/L account and thus also to a primary cost element.

If an origin group is entered in the costing view of the material master record, the combination of origin group and cost element is updated in the Controlling module.

If the Material origin indicator in the costing view of the material master record is specified in addition to the origin group, the costs are updated under the combination of material number and cost element in the Controlling component.

You can do the following for each cost element and origin group:

Calculate overhead

If you have maintained origin groups for the raw materials, you can define a calculation base in the costing sheet for each group of raw materials. This enables you to define different overhead surcharges for each group of raw materials.

Make assignments to cost components

If you have maintained origin groups for the raw materials, you can create separate cost components for important materials or groups of materials.

Calculate variances

Variances are calculated for each cost element. If you have maintained origin groups for the materials used, the variances (such as input price variances and input quantity variances) will be calculated not only for the relevant material cost element but also for each origin group assigned to that cost element.

Calculate work in process or results analysis data

For each cost element, you can specify whether the work in process for those costs can be capitalized in the balance sheet. If you have maintained origin groups for the materials used, you can specify this separately for each origin group.

There is other way around to calculate and overhead cost which is not part of this explaination

Template allocation

Here, cost drivers are used to assign overhead to the reference object on a source-related basis according to usage. The overhead is applied by means of templates. Sender objects can be business processes or cost centers/activity types.

Integration of business processes into the routing

Assigning process costs to routing operations is particularly suitable for direct production processes. On the other hand, indirect processes should be assigned using templates.

I will continue to edit this document for enhancing the quality of document.In my Next document i will explain about Costing Run and different other aspect of material setting that affect costing.

Document Level- Beginners

Refer to previous Document here-

Source: scn.sap.com

ReplyDeleteSAP MM TrainingChennai, furnish the best training with Real-time projects. We configured the course as for the Industrial demands. We offers long-term support.

sap fico training in chennai

thanks for the information sap simple finance training in chennai

ReplyDelete