What is Revenue Recognition?

To understand what is Revenue Recognition, we need to understand what are the basic accounting principles which guide all the accounting standards across the world. There are two basic accounting principles

The need for Revenue recognition arises because of growing size of business houses globally and various accounting standards followed across the globe. The major are listed below

Revenue Recognition can be classified based on time frame and on the basis of occurring event. Below are the three classification.

Service related revenue recognition can be best understood as contracts made for maintenance of equipment after the guaranteed period. Wherein, unless for the monthly maintenance, either in terms of general maintenance or replacement of part, of equipment is identified; revenue is not noted in the books of accounts.

Business Scenario

Contract for certain period of time.

To understand what is Revenue Recognition, we need to understand what are the basic accounting principles which guide all the accounting standards across the world. There are two basic accounting principles

- Accrued System

- Cash System

- Accrued system of accounting

- The below points make it clear to understand the accrual system of accounting

- The Accrual Method of Accounting matches revenues when they are earned against expenses associated with those revenues.

- Under accrual accounting, if your business receives a bill, that bill is counted as an expense, even though you have not yet paid the bill.

- In the same way, if you bill a customer, that bill is counted as income, even though you have not yet received payment.

- Cash system of accounting, or, Deferred system of accounting

- When cash is received or

- When a payment is made.

The need for Revenue recognition arises because of growing size of business houses globally and various accounting standards followed across the globe. The major are listed below

- Generally Accepted Accounting Principles (US-GAAP),

- International Accounting Standards (IAS),

- Financial Reporting Standards (IFRS), as well as,

- Sarbanes-Oxley Act.

Revenue Recognition can be classified based on time frame and on the basis of occurring event. Below are the three classification.

- Standard revenue recognition

- means that the billing document posts directly to a revenue account. This posting is made without involving the Accrual Engine, i.e. without a revenue recognition process.

- Periodic (time-related) revenue recognition

- means that the revenue from a sale is distributed and posted equally across the entire contract validity period. Billing posts to an accruals account here and revenues are first transfer posted to the revenue accounts in a second step.

- Service-related revenue recognition

- means that the revenue is recognized as the result of an event such as a confirmation or a delivery. Billing also posts to an accruals account here and revenues are first transfer posted to the revenue accounts in a second step.

Service related revenue recognition can be best understood as contracts made for maintenance of equipment after the guaranteed period. Wherein, unless for the monthly maintenance, either in terms of general maintenance or replacement of part, of equipment is identified; revenue is not noted in the books of accounts.

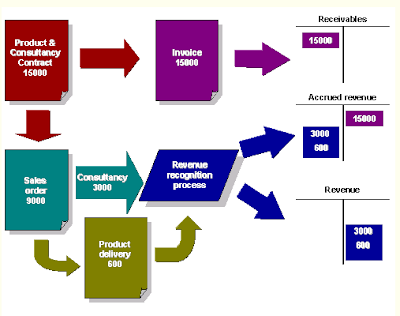

Business Scenario

Contract for certain period of time.

- A contract is created in the system for certain period of time. The contract is either Time Based or Event Based.

- In time based contracts, irrespective of the services rendered, either on site or offshore to the product, revenue is raised at periodic intervals. The intervals can be monthly, bi-monthly or any other period frame. But the entire contract revenue is collected in the book of accounts as Accrued revenue.

- In event based system of Revenue Recognition the accrual revenue is noted in the as the result of an event such as a confirmation or a delivery. On such an event billing also posts to accruals account in the first step and revenues are transferred the revenue accounts in a second step.

- Standard Revenue recognition

- Time related Revenue recognition

- Service related revenue recognition - On happening of an event.

Source: scn.sap.com

Thanks for sharing the information SAP FICO Training

ReplyDelete

ReplyDeleteSAP MM TrainingChennai, furnish the best training with Real-time projects. We configured the course as for the Industrial demands. We offers long-term support.

sap fico training in chennai

thanks for the information sap fico training in chennai

ReplyDelete