Assumption: Reader is aware of basic "Automatic Payment Process" concepts.

Most of us are familiar with online banking transactions. There would be thousands of bank transactions happening 24/7. Did you ever think, how does payment reaches a bank/payee, if it is done on a bank holiday or on a Sunday (Global holiday in most of the countries)? Usually banks refer to value date while making a payment to payee instead of transaction date. In case of real time transfers, value date and transaction date are same. In case of payments with say check, value date may be in future as well. Aligning this kind of requirement to SAP, usually payments are handled in SAP through automatic payment program (F110) or manual payments (F111). To understand the complete process in a better manner, first we need to understand few terminology used in payment process.

Payment media: This is the means of communicating the payment related information to bank. This would have information like payee details, bank account, amount to be paid etc.

E.g.: Payment media can be sent to bank through payment IDOC, flat file, XML file etc.

Value date: This is the date on which bank has to dispatch the money to payee account. Please note that payment media is sent in advance to the date on which payment is to be made to payee. How many days before a payment media should be sent to bank is controlled through configuration.

Payment advice: This is the communication sent to payee/accounting clerk (In some cases where vendor doesn't have e-mail address) stating with the details of the payments done (List of paid invoices, amount, payment currency etc.) and to which bank account payment is made. This helps the payee to stay updated about the payment progress.

Usually, F110/F111 is run on a weekday and payment media is generated immediately and sent to bank. But, bank will start the payment process on the value date mentioned in the payment media.

Value date configuration and calculation logic:

Value date can be calculated in two different ways.

Go to below path in FBZP.

Most of us are familiar with online banking transactions. There would be thousands of bank transactions happening 24/7. Did you ever think, how does payment reaches a bank/payee, if it is done on a bank holiday or on a Sunday (Global holiday in most of the countries)? Usually banks refer to value date while making a payment to payee instead of transaction date. In case of real time transfers, value date and transaction date are same. In case of payments with say check, value date may be in future as well. Aligning this kind of requirement to SAP, usually payments are handled in SAP through automatic payment program (F110) or manual payments (F111). To understand the complete process in a better manner, first we need to understand few terminology used in payment process.

Payment media: This is the means of communicating the payment related information to bank. This would have information like payee details, bank account, amount to be paid etc.

E.g.: Payment media can be sent to bank through payment IDOC, flat file, XML file etc.

Value date: This is the date on which bank has to dispatch the money to payee account. Please note that payment media is sent in advance to the date on which payment is to be made to payee. How many days before a payment media should be sent to bank is controlled through configuration.

Payment advice: This is the communication sent to payee/accounting clerk (In some cases where vendor doesn't have e-mail address) stating with the details of the payments done (List of paid invoices, amount, payment currency etc.) and to which bank account payment is made. This helps the payee to stay updated about the payment progress.

Usually, F110/F111 is run on a weekday and payment media is generated immediately and sent to bank. But, bank will start the payment process on the value date mentioned in the payment media.

Value date configuration and calculation logic:

Value date can be calculated in two different ways.

- Without bank calendar

- With bank calendar

Go to below path in FBZP.

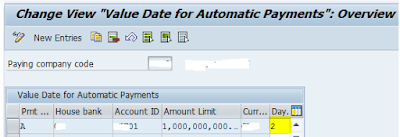

Enter required company code and proceed. In the next screen, you can assign the number of days to be added to value date.

By default, value date is same as posting date entered in the payment run. Number of days can be assigned at payment method, House bank, account ID, Amount and currency level.

We can assign different number of days for different amount limit for the same account , currency and payment method

E.G: All checks (Check payment method) up to 100000 USD should be paid on 1 day after the payment run and 100001 USD onwards, should be paid 2 days after the payment run. This feature helps to manage the cash flow and funds in a better manner and won’t cause sudden plunge of bank account balance due to unexpected huge payments. Business will have enough

time to analyze the funds situation at any point in time.

Value date calculation with bank calendar:

This has two steps.

Configuring value date rules:

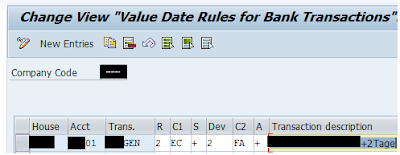

Go to value date rules from FBZP as shown below. Enter the company code and proceed.

Enter the house bank, account ID, Transaction name(Free field).

Reference date for determining the value date: This can have below options.

1. Document date

2. Posting date

3. Due Date

Most of the cases, posting date is selected as value date base line date (Reference date).

Calendar 1: This is the factory calendar ID used for calculating the value date. Bank holidays defined in this calendar are considered while calculating value date.

+ or – sign indicates weather the number of days mentioned is to be added/subtracted.

E.G: If the value date reference is posting date, Payment run Posting date = 01.04.2014

Considering above screenshot,

If 1st April is a holiday as per calendar EC, then value date base line would be 02.04.2014.

If 1st April is a working day as per calendar EC, then value date base line would be 01.04.2014.

Deviation from reference date in days: Number of days mentioned here are added/subtracted based on the sign column to the value date base line date.

From above example, value date calculation happens as below

If 1st April is a holiday as per calendar EC, then value date base line would be 02.04.2014, value date = value date base line + 2 days = 04.04.2014

If 1st April is a working day as per calendar EC, then value date base line would be 01.04.2014, value date = value date base line + 2 days = 03.04.2014

Once transaction name with the value date calculation rule is configured, next step is to assign this transaction to payment method.

Go to below path in FBZP. Enter company code and continue.

Enter the payment method, Transaction, House bank, account ID and the transaction name created above.

Don’t get confused with the transaction entered in second column with the one in sixth column. The one in second column is used for distinguishing different types of transactions for the same payment method. Below values are allowed here.

Space Transaction not relevant

1. Bill/exch. for discount

2. Bill/exch. for collection

3. Check deposit at same bank

4. Check deposit in same region

5. Check deposit (general)

This allows to configure different value date rule for same payment method.

EG: If payment method A is used for check payments, check at same bank might need lesser time compared to check in different bank in same region.

Usually transaction in second column is maintained as blank. The one in sixth column is used for determining value date rules (Configured in previous step).

These steps completes the configuration of value date calculation. These rules would be used when payment media is generated and during value date calculation.

Note: Custom logic can be written in payment user exits if standard customization doesn't meet the requirement.

You can also check the connected blog on Bank/Factory calendar creation.

Bank/Factory calendar creation: Step by step process

Source: scn.sap.com

thanks for the information sap fico training in chennai

ReplyDelete